Life Insurance Strategies for Business Owners

Owning a business can be like parenting. You’ve likely experienced many sleepless nights and spent a countless amount of energy on your “baby.” Like parenting, being a business owner can be an enriching journey and make life worth the trip.

From Tax Efficiency to Retirement: Financial Planning for Small Business Owners

Financial planning for a small business gets more complicated every day. Business owners must navigate tax efficiency (and life under the new Tax Cuts and Jobs Act), retirement preparations for yourself and your employees, and succession planning. Get your financial plan in place today and …

8 Financial Planning Tips for Small Business Owners

Running a small business involves juggling multiple responsibilities. Managing the business’s finances is one of the most crucial aspects. Proper financial management can be the difference between a thriving business and one that struggles to stay afloat. Here are eight essential financial …

The Corporate Transparency Act: What You Need to Know

By Mike Valenti, CPA, CFP®, Director,Tax Planning LLCs can provide legal protections and a level of anonymity, either or both of which can be beneficial for business owners, investors, and others with valid intentions. But those features also attract criminal activity, and layers of shell c …

Three Methods to Effectively Value Your Business

While watching a documentary on Andrew Carnegie, one of the scenes really stood out to me. It depicted the earlier years of his career, stressing over unpaid bills and expenses, and trying to make payroll. It was something every successful business owner can relate to.

Your Qualified Small Business Stock Questions Answered

Many business owners who exit their companies experience liquidity events, sometimes these can be substantial creating multi-generational wealth. For entrepreneurs and those advising them, understanding the nuances of their business exit is crucial, remember the devil is always in the deta …

Life Insurance for Business and Estate Planning

By Matt Lewis, CLTC, Vice President, Insurance Life insurance is designed to provide for your loved ones after your death, giving you peace of mind that their financial needs will be met without your income. But life insurance can benefit your financial planning in many other ways.

Value of a Wealth Advisor

The Unparalleled Value of an Experienced Financial Advisor Navigating the complex world of financial planning and investment management can be a daunting task for people. The sheer volume of information, investment options, and potential pitfalls can leave many feelings overwhelmed. This is …

Financial Media Analysts and Pundits Getting It Wrong

Why Pundits Get It Wrong With over 23 years of experience in the financial industry, I have seen my fair share of market ups and downs. One thing that I have noticed is the tendency for analysts, pundits, and the financial media to get it wrong when it comes to predicting market trends. It …

Building Your Ideal Business Succession Plan

By Odaro Aisueni, CFP®, Wealth Planning Administrator As a small business owner, you’re likely so immersed in the routine functions of your business that you haven’t yet put much thought into the day you leave it behind. In fact, most small business owners have so much purpose t …

Financial Freedom

The phrases financial freedom and financial independence get thrown around a lot, yet nobody really quantifies what that actually means. What I hope to impart to you is an understanding of what financial freedom is and how you can begin taking the necessary actions to help you pursue it. Su …

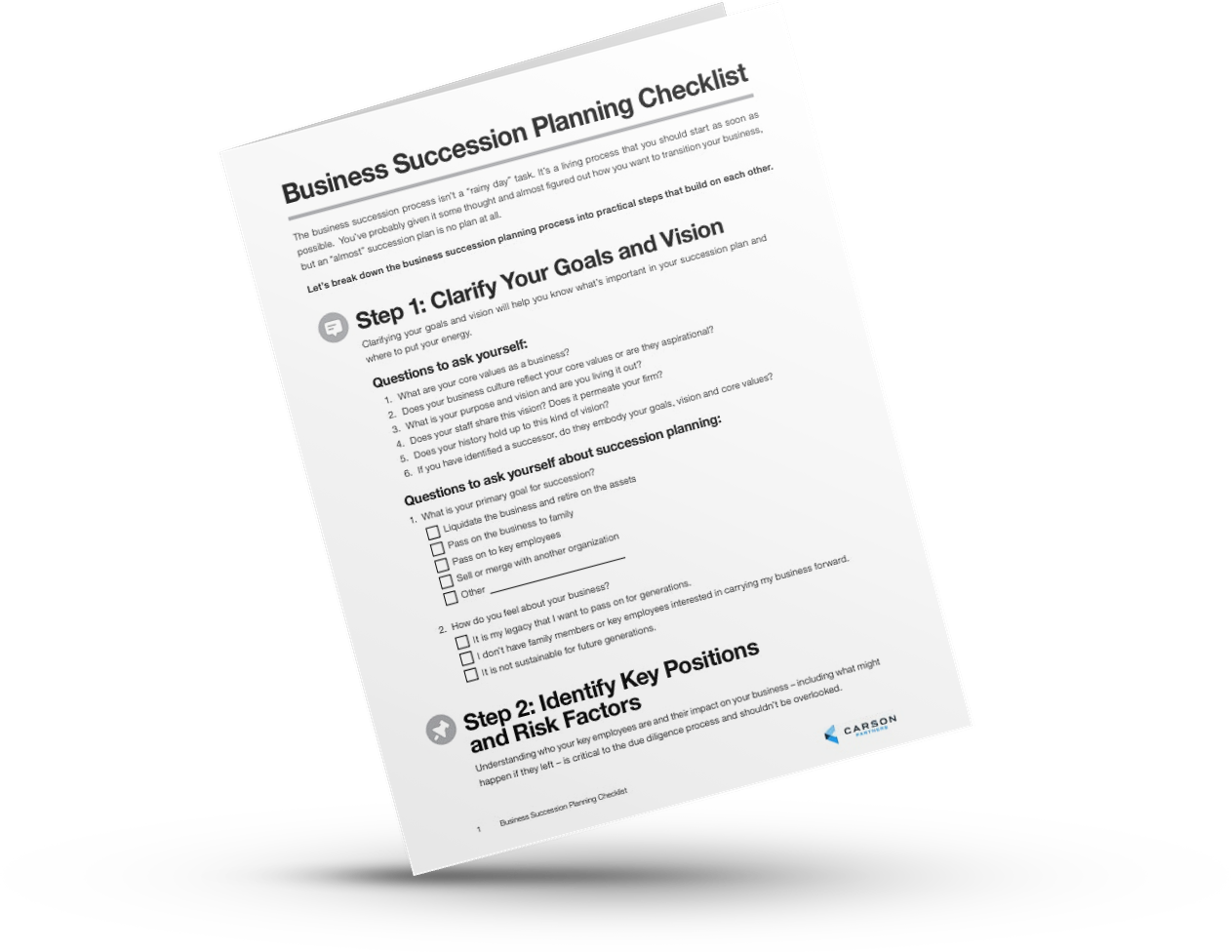

COMPLIMENTARY RESOURCE

Business Succession Planning Checklist

You remember your first day of business. But what about your last day? Succession planning is more complex than it may seem. Our guide walks you through the details.